Forward-Looking Statements

This presentation includes certain forward-looking statements, including statements about the proposed

acquisition of General Communication, Inc. (“GCI”) by Liberty Interactive Corporation (“Liberty

Interactive”) and the proposed split-off of Liberty Interactive’s interest in the combined company (“GCI

Liberty”) (the “proposed split-off ” and together with the proposed acquisition of GCI, the “proposed

transactions”), the timing of the proposed transactions, the contemplated reincorporation of GCI Liberty,

the proposed reattribution or sale of assets and liabilities at Liberty Interactive in connection with the

proposed transactions, the renaming of Liberty Interactive, GCI Liberty’s entry into a margin loan

arrangement prior to the completion of the proposed transaction, Liberty Interactive’s anticipated offer to

exchange any or all of its outstanding 1.75% Charter exchangeable debentures, the realization of estimated

synergies and benefits from the proposed transactions, business strategies, market potential, future financial

prospects and other matters that are not historical facts. These forward-looking statements involve many

risks and uncertainties that could cause actual results to differ materially from those expressed or implied by

such statements, including, without limitation, the satisfaction of conditions to the proposed transactions.

These forward-looking statements speak only as of the date of this presentation, and each of Liberty

Interactive and GCI expressly disclaim any obligation or undertaking to disseminate any updates or

revisions to any forward-looking statement contained herein to reflect any change in Liberty Interactive’s or

GCI’s expectations with regard thereto or any change in events, conditions or circumstances on which any

such statement is based. Please refer to the publicly filed documents of Liberty Interactive and GCI,

including the most recent Forms 10-K, for additional information about Liberty Interactive and GCI and

about the risks and uncertainties related to the business of each of Liberty Interactive and GCI which may

affect the statements made in this presentation.

Additional Disclaimers

Additional Information

Nothing in this presentation shall constitute a solicitation to buy or an offer to sell shares of GCI Liberty,

GCI common stock or any of Liberty Interactive’s tracking stocks. The offer and sale of shares in the

proposed transactions will only be made pursuant to GCI Liberty’s effective registration statement. Liberty

Interactive stockholders, GCI stockholders and other investors are urged to read the registration statement

and the joint proxy statement/prospectus to be filed regarding the proposed transactions and any other

relevant documents filed with the SEC, as well as any amendments or supplements to those documents,

because they will contain important information about the proposed transactions. Copies of these SEC

filings are available free of charge at the SEC’s website (http://www.sec.gov). Copies of the filings together

with the materials incorporated by reference therein are also available, without charge, by directing a request

to Liberty Interactive Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112, Attention:

Investor Relations, Telephone: (720) 875-5420. GCI investors can access additional information at

ir.gci.com.

Participants in a Solicitation

The directors and executive officers of Liberty Interactive and GCI and other persons may be deemed to

be participants in the solicitation of proxies in respect of proposals to approve the proposed transactions.

Information regarding the directors and executive officers of Liberty Interactive is available in its definitive

proxy statement, which was filed with the SEC on July 8, 2016, and certain of its Current Reports on

Form 8-K. Information regarding the directors and executive officers of GCI is available as part of its

Form 10-K filed with the SEC on March 2, 2017. For other information regarding the participants in the

proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise,

will be available in the proxy materials regarding the foregoing to be filed with the SEC. Free copies of these

documents may be obtained as described in the preceding paragraph.

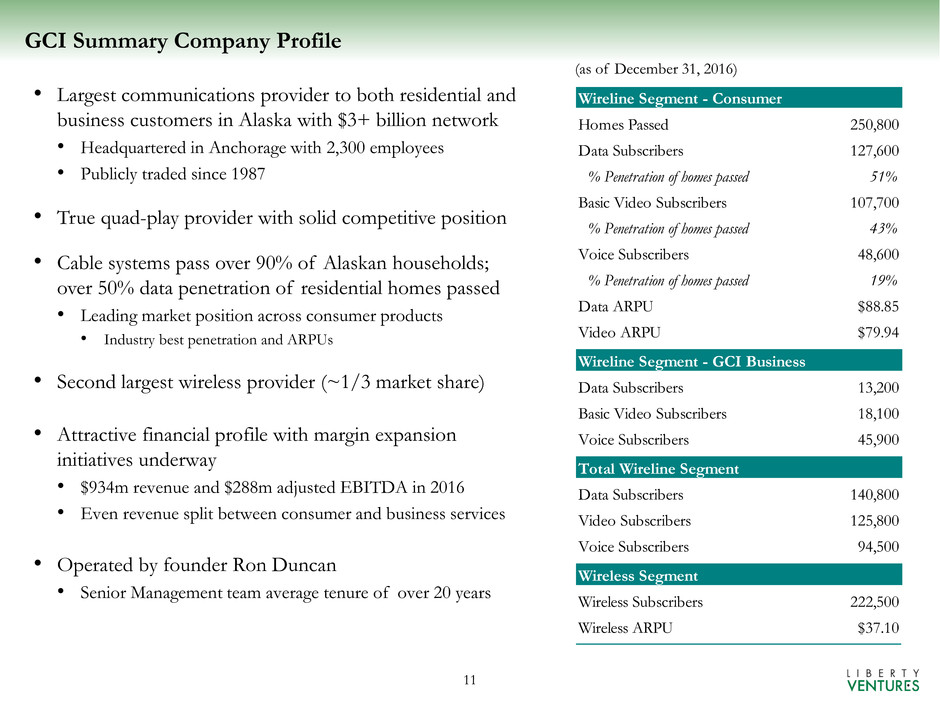

GCI Summary Company Profile

• Largest communications provider to both residential and

business customers in Alaska with $3+ billion network

• Headquartered in Anchorage with 2,300 employees

• Publicly traded since 1987

• True quad-play provider with solid competitive position

• Cable systems pass over 90% of Alaskan households;

over 50% data penetration of residential homes passed

• Leading market position across consumer products

• Industry best penetration and ARPUs

• Second largest wireless provider (~1/3 market share)

• Attractive financial profile with margin expansion

initiatives underway

• $934m revenue and $288m adjusted EBITDA in 2016

• Even revenue split between consumer and business services

• Operated by founder Ron Duncan

• Senior Management team average tenure of over 20 years

(as of December 31, 2016)

Wireline Segment - Consumer

Homes Passed 250,800

Data Subscribers 127,600

% Penetration of homes passed 51%

Basic Video Subscribers 107,700

% Penetration of homes passed 43%

Voice Subscribers 48,600

% Penetration of homes passed 19%

Data ARPU $88.85

Video ARPU $79.94

Wireline Segment - GCI Business

Data Subscribers 13,200

Basic Video Subscribers 18,100

Voice Subscribers 45,900

Total Wireline Segment

Data Subscribers 140,800

Video Subscribers 125,800

Voice Subscribers 94,500

Wireless Segment

Wireless Subscribers 222,500

Wireless ARPU $37.10

11

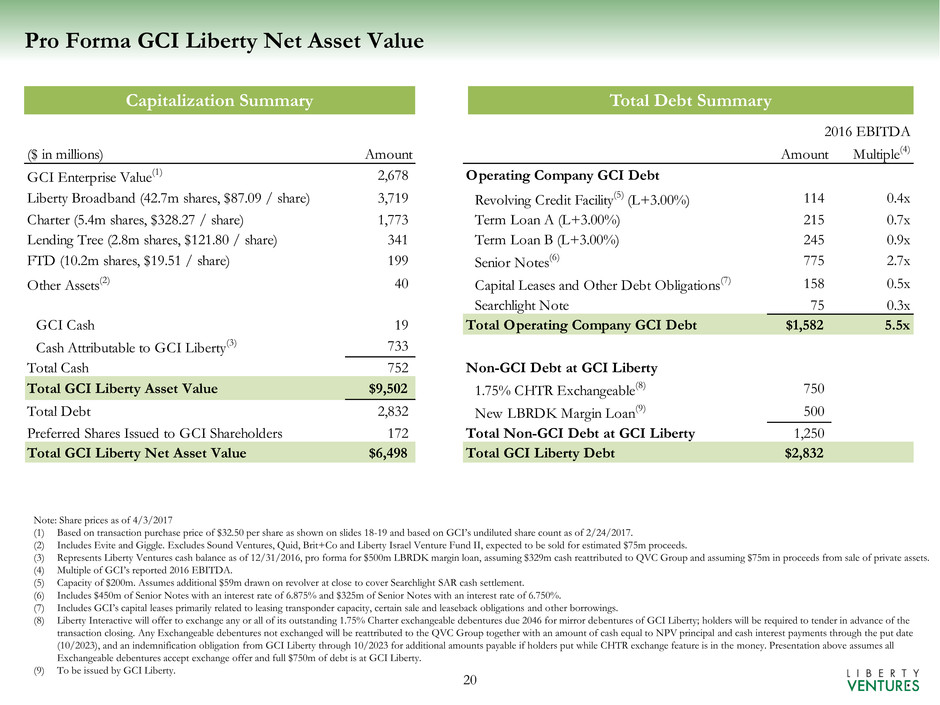

Pro Forma GCI Liberty Net Asset Value

Capitalization Summary Total Debt Summary

Note: Share prices as of 4/3/2017

(1) Based on transaction purchase price of $32.50 per share as shown on slides 18-19 and based on GCI’s undiluted share count as of 2/24/2017.

(2) Includes Evite and Giggle. Excludes Sound Ventures, Quid, Brit+Co and Liberty Israel Venture Fund II, expected to be sold for estimated $75m proceeds.

(3) Represents Liberty Ventures cash balance as of 12/31/2016, pro forma for $500m LBRDK margin loan, assuming $329m cash reattributed to QVC Group and assuming $75m in proceeds from sale of private assets.

(4) Multiple of GCI’s reported 2016 EBITDA.

(5) Capacity of $200m. Assumes additional $59m drawn on revolver at close to cover Searchlight SAR cash settlement.

(6) Includes $450m of Senior Notes with an interest rate of 6.875% and $325m of Senior Notes with an interest rate of 6.750%.

(7) Includes GCI’s capital leases primarily related to leasing transponder capacity, certain sale and leaseback obligations and other borrowings.

(8) Liberty Interactive will offer to exchange any or all of its outstanding 1.75% Charter exchangeable debentures due 2046 for mirror debentures of GCI Liberty; holders will be required to tender in advance of the

transaction closing. Any Exchangeable debentures not exchanged will be reattributed to the QVC Group together with an amount of cash equal to NPV principal and cash interest payments through the put date

(10/2023), and an indemnification obligation from GCI Liberty through 10/2023 for additional amounts payable if holders put while CHTR exchange feature is in the money. Presentation above assumes all

Exchangeable debentures accept exchange offer and full $750m of debt is at GCI Liberty.

(9) To be issued by GCI Liberty.

2016 EBITDA

($ in millions) Amount Amount Multiple

(4)

GCI Enterprise Value

(1) 2,678 Operating Company GCI Debt

Liberty Broadband (42.7m shares, $87.09 / share) 3,719 Revolving Credit Facility

(5)

(L+3.00%) 114 0.4x

Charter (5.4m shares, $328.27 / share) 1,773 Term Loan A (L+3.00%) 215 0.7x

Lending Tree (2.8m shares, $121.80 / share) 341 Term Loan B (L+3.00%) 245 0.9x

FTD (10.2m shares, $19.51 / share) 199 Senior Notes

(6) 775 2.7x

Other Assets

(2) 40 Capital Leases and Other Debt Obligations

(7) 158 0.5x

Searchlight Note 75 0.3x

GCI Cash 19 Total Operating Company GCI Debt $1,582 5.5x

Cash Attributable to GCI Liberty

(3) 733

Total Cash 752 Non-GCI Debt at GCI Liberty

Total GCI Liberty Asset Value $9,502 1.75% CHTR Exchangeable

(8) 750

Total Debt 2,832 New LBRDK Margin Loan

(9) 500

Preferred Shares Issued to GCI Shareholders 172 Total Non-GCI Debt at GCI Liberty 1,250

Total GCI Liberty Net Asset Value $6,498 Total GCI Liberty Debt $2,832

20