Liberty Broadband and GCI Liberty Combination August 6, 2020 and EXHIBIT 99.2

2 Cautionary Statements; Disclaimer Forward Looking Statements This presentation includes forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements other than statements of historical fact are “forward - looking statements” for purposes of federal and state securities laws . These forward - looking statements generally can be identified by phrases such as “possible,” “proposed,” “potential,” “intends” or “expects” or other words or phrases of similar import or future or conditional verbs such as “will,” “may,” “might,” “should,” “would,” “could,” or similar variations . Similarly, statements herein that describe the proposed transaction between Liberty Broadband Corporation (“Liberty Broadband”) and GCI Liberty, Inc . (“GCI Liberty”) (the “Combination”), including its financial and operational impact, tax matters, the timing of the Combination, the expected benefits of the Combination, the pro forma net asset value and ownership structure of Liberty Broadband following the Combination, the expected treatment of GCI Liberty’s margin loan in connection with the Combination, Liberty Broadband’s ownership interest in Charter Communications, Inc . following the Combination, Liberty Broadband’s stock repurchase program and other statements of the parties’ or management’s plans, expectations, objectives, projections, beliefs, intentions, goals, and statements about the benefits of the Combination, and other statements that are not historical facts are also forward - looking statements . It is uncertain whether any of the events anticipated by the forward - looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the combined companies or the price of Liberty Broadband or GCI Liberty stock . These forward - looking statements involve certain risks and uncertainties, many of which are beyond the parties’ control, that could cause actual results to differ materially from those indicated in such forward - looking statements, including, but not limited to, the unpredictability of the commercial success of Liberty Broadband’s or GCI Liberty’s respective businesses or operations ; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Combination ; the risk that any announcements relating to the Combination could have adverse effects on the market price of common stock of Liberty Broadband or GCI Liberty ; market conditions conducive to stock repurchases, the ability of the parties to consummate the Combination on a timely basis or at all and the satisfaction of the conditions precedent to consummation of the Combination, including, but not limited to, approval by the stockholders of Liberty Broadband and GCI Liberty and regulatory approvals ; the possibility that the Combination may be more expensive to complete than anticipated, including as a result of unexpected factors or events ; the ability to successfully integrate the businesses ; the ability of Liberty Broadband to implement its plans, forecasts and other expectations with respect to GCI Liberty’s business after the completion of the Combination and realize expected benefits ; the diversion of management’s attention from ongoing business operations and opportunities ; the impact of COVID - 19 ; and litigation relating to the Combination . These forward - looking statements speak only as of the date of this presentation, and each of Liberty Broadband and GCI Liberty expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward - looking statement contained herein to reflect any change in Liberty Broadband’s or GCI Liberty’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based . Please refer to the publicly filed documents of each of Liberty Broadband and GCI Liberty, including the most recent Annual Reports on Form 10 - K and Quarterly Reports on Form 10 - Q, for additional information about Liberty Broadband and GCI Liberty and about the risks and uncertainties related to the businesses of Liberty Broadband and GCI Liberty which may affect the statements made in this presentation . Additional Information Nothing in this presentation shall constitute a solicitation to buy or an offer to sell securities of Liberty Broadband or GC I L iberty. The offer and sale of shares in the Combination will only be made pursuant to Liberty Broadband’s effective registration statement. Liberty Broadband’s stockholders, GCI Liberty’s stockholders and other investors are urged to read the registration statement and the joint proxy s tatement/prospectus to be filed regarding the Combination and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, be cause they will contain important information about the Combination. Copies of these SEC filings are available free of charge at the SEC’s website (http://www.sec.gov). Copies of Liberty Broadband’s filings together with the materials incorporated by reference therein are also available, without charge, by directing a requ es t to Liberty Broadband Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112, Attention: Investor Relations, Telephone: (72 0) 875 - 5700. Copies of GCI Liberty’s filings together with the materials incorporated by reference therein are also available, without charge, by directing a request to GCI Liberty, Inc., 12300 Liberty Boulevard, Englewood, Col orado 80112, Attention: Investor Relations, Telephone: (720) 875 - 5900. Participants in a Solicitation Liberty Broadband and GCI Liberty and their respective directors and executive officers and other persons may be deemed to be pa rticipants in the solicitation of proxies in respect of the Combination. Information about Liberty Broadband’s directors and executive officers is available in Liberty Broadband’s definitive proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on April 10, 2020. Infor ma tion about GCI Liberty’s directors and executive officers is available in GCI Liberty’s definitive proxy statement for its 2020 annual meeting of stoc kho lders, which was filed with the SEC on April 10, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be conta ine d in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Combination when they become available. Investors should read the joint proxy statement/prospectus carefully when it becomes ava ilable before making any voting or investment decisions. You may obtain free copies of these documents from Liberty Broadband and GCI Liberty as indicated above.

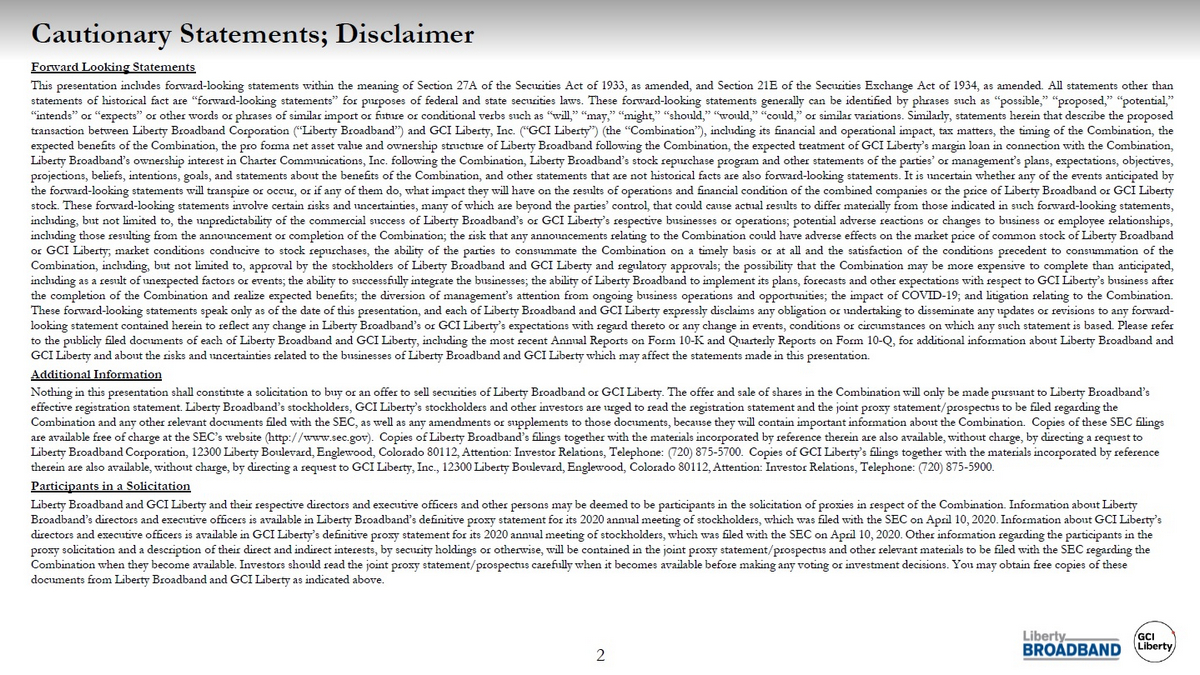

3 Liberty Broadband and GCI Liberty to Combine in Stock - for - Stock Merger Current Structure Pro Forma Liberty Broadband 26% 100% 2 % (1) 23% 100% 22% / 25.01% (1) 100% (1) Denotes Fully Diluted Ownership / Voting Control. Fully Diluted Ownership calculated for purposes of equity ownership cap: currently 22.2% at LBRD, 2.2% at GLIB and 24.4% pro forma (including dilutive impact of Advance/Newhouse Partnership convertible preferred and partnership units). Dilutive securities as of 12/31/19 per CHTR 2019 10 - K. Based on Charter shares outstanding as of 6/30/20, pro forma for subsequent A/N share sales as of 7/31/20: basic ownership currently 26% at LBRD, 3% at GLIB and 29% pro forma. 100 % 100% 26 % 100 % 24 % / 25.01% (1)

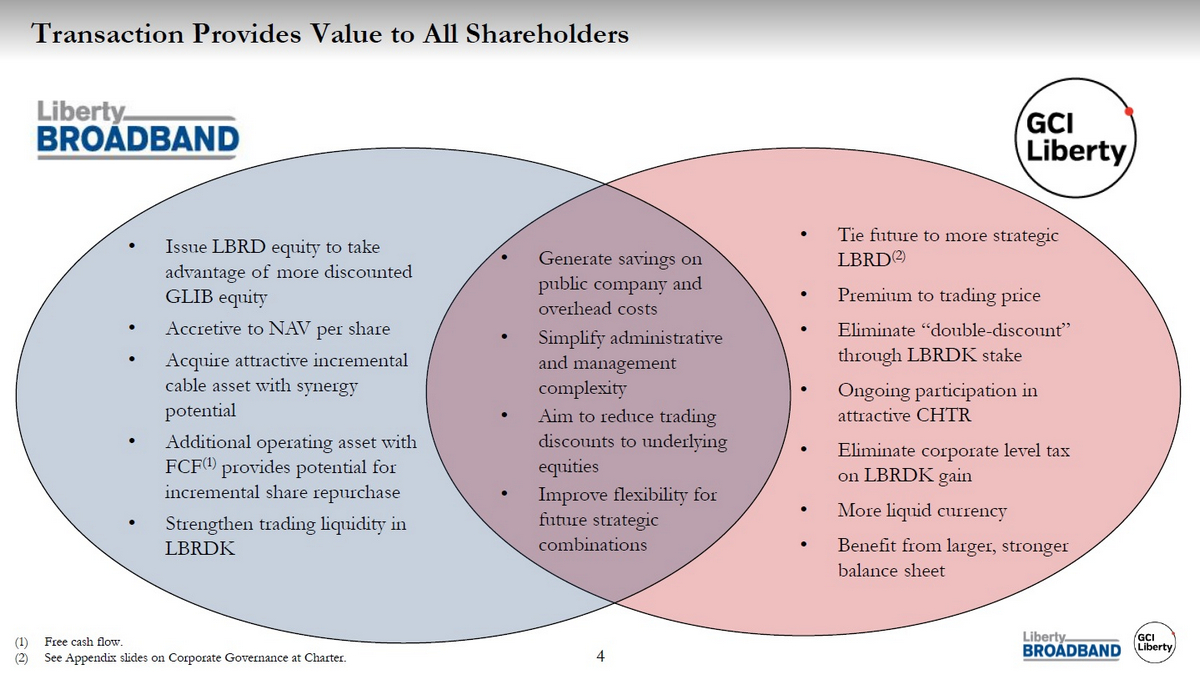

4 Transaction Provides Value to All Shareholders • Tie future to more strategic LBRD (2) • Premium to trading price • Eliminate “double - discount” through LBRDK stake • Ongoing participation in attractive CHTR • Eliminate corporate level tax on LBRDK gain • More liquid currency • Benefit from larger, stronger balance sheet • Generate savings on public company and overhead costs • Simplify administrative and management complexity • Aim to reduce trading discounts to underlying equities • Improve flexibility for future strategic combinations • Issue LBRD equity to take advantage of more discounted GLIB equity • Accretive to NAV per share • Acquire attractive incremental cable asset with synergy potential • Additional operating asset with FCF (1) provides potential for incremental share repurchase • Strengthen trading liquidity in LBRDK (1) Free cash flow. (2) See Appendix slides on Corporate Governance at Charter.

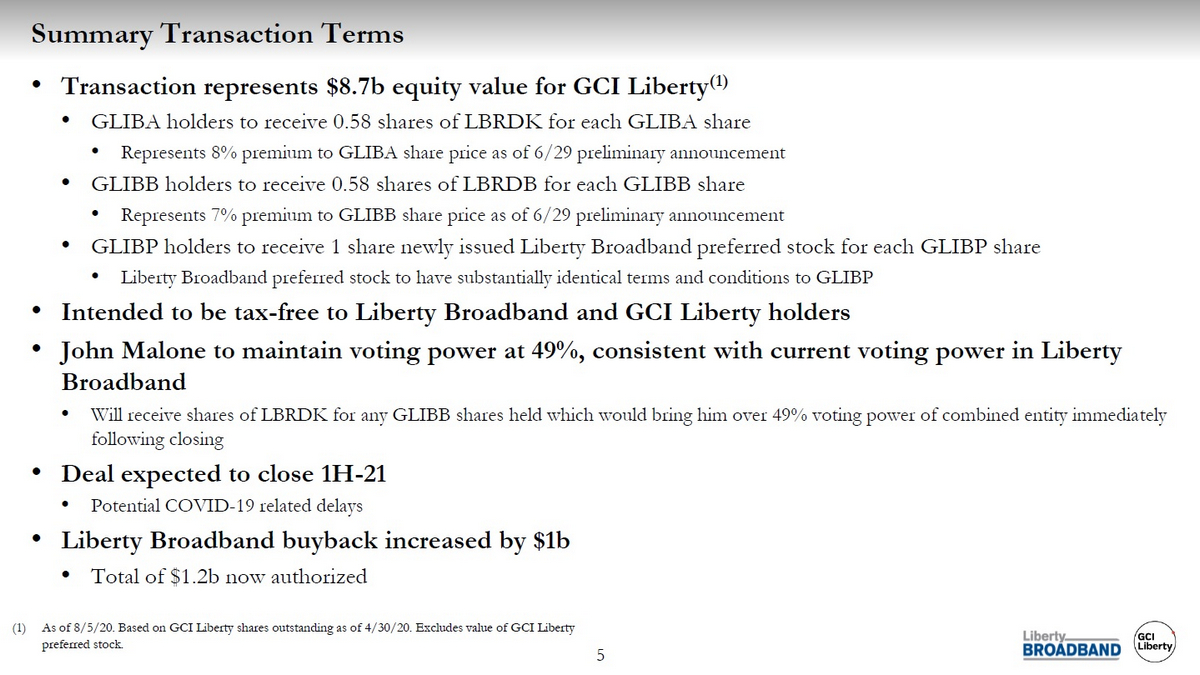

5 Summary Transaction Terms • Transaction represents $8.7b equity value for GCI Liberty (1) • GLIBA holders to receive 0.58 shares of LBRDK for each GLIBA share • Represents 8% premium to GLIBA share price as of 6/29 preliminary announcement • GLIBB holders to receive 0.58 shares of LBRDB for each GLIBB share • Represents 7% premium to GLIBB share price as of 6/29 preliminary announcement • GLIBP holders to receive 1 share newly issued Liberty Broadband preferred stock for each GLIBP share • Liberty Broadband preferred stock to have substantially identical terms and conditions to GLIBP • Intended to be tax - free to Liberty Broadband and GCI Liberty holders • John Malone to maintain voting power at 49%, consistent with current voting power in Liberty Broadband • Will receive shares of LBRDK for any GLIBB shares held which would bring him over 49% voting power of combined entity immedia tel y following closing • Deal expected to close 1H - 21 • Potential COVID - 19 related delays • Liberty Broadband buyback increased by $1b • Total of $1.2b now authorized (1) As of 8/5/20. Based on GCI Liberty shares outstanding as of 4/30/20. Excludes value of GCI Liberty preferred stock.

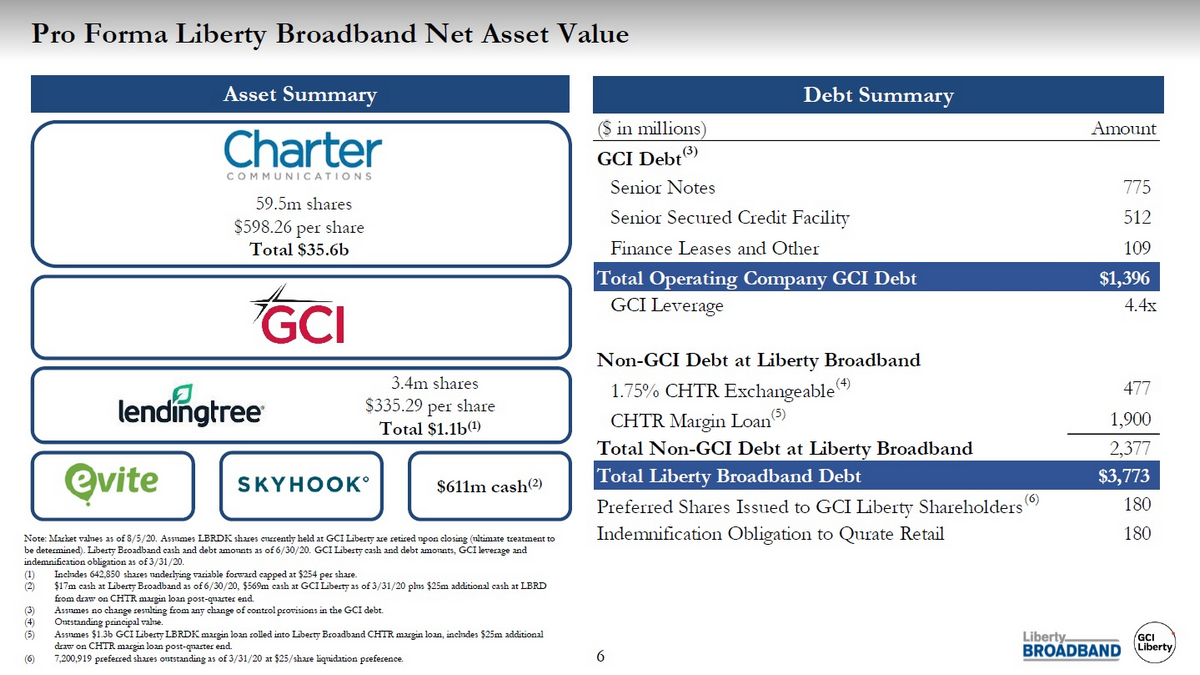

6 Pro Forma Liberty Broadband Net Asset Value Asset Summary Debt Summary Note: Market values as of 8/5/20. Assumes LBRDK shares currently held at GCI Liberty are retired upon closing (ultimate treat men t to be determined). Liberty Broadband cash and debt amounts as of 6/30/20. GCI Liberty cash and debt amounts, GCI leverage and indemnification obligation as of 3/31/20. (1) Includes 642,850 shares underlying variable forward capped at $254 per share. (2) $17m cash at Liberty Broadband as of 6/30/20, $569m cash at GCI Liberty as of 3/31/20 plus $25m additional cash at LBRD from draw on CHTR margin loan post - quarter end. (3) Assumes no change resulting from any change of control provisions in the GCI debt. (4) Outstanding principal value. (5) Assumes $1.3b GCI Liberty LBRDK margin loan rolled into Liberty Broadband CHTR margin loan, includes $25m additional draw on CHTR margin loan post - quarter end. (6) 7,200,919 preferred shares outstanding as of 3/31/20 at $25/share liquidation preference. ($ in millions) Amount GCI Debt (3) Senior Notes 775 Senior Secured Credit Facility 512 Finance Leases and Other 109 Total Operating Company GCI Debt $1,396 GCI Leverage 4.4x Non-GCI Debt at Liberty Broadband 1.75% CHTR Exchangeable (4) 477 CHTR Margin Loan (5) 1,900 Total Non-GCI Debt at Liberty Broadband 2,377 Total Liberty Broadband Debt $3,773 Preferred Shares Issued to GCI Liberty Shareholders (6) 180 Indemnification Obligation to Qurate Retail 180 $ 611 m cash (2) 5 59.5m shares $598.26 per share Total $35.6b 5 3.4m shares $335.29 per share Total $1.1b (1)

Appendix

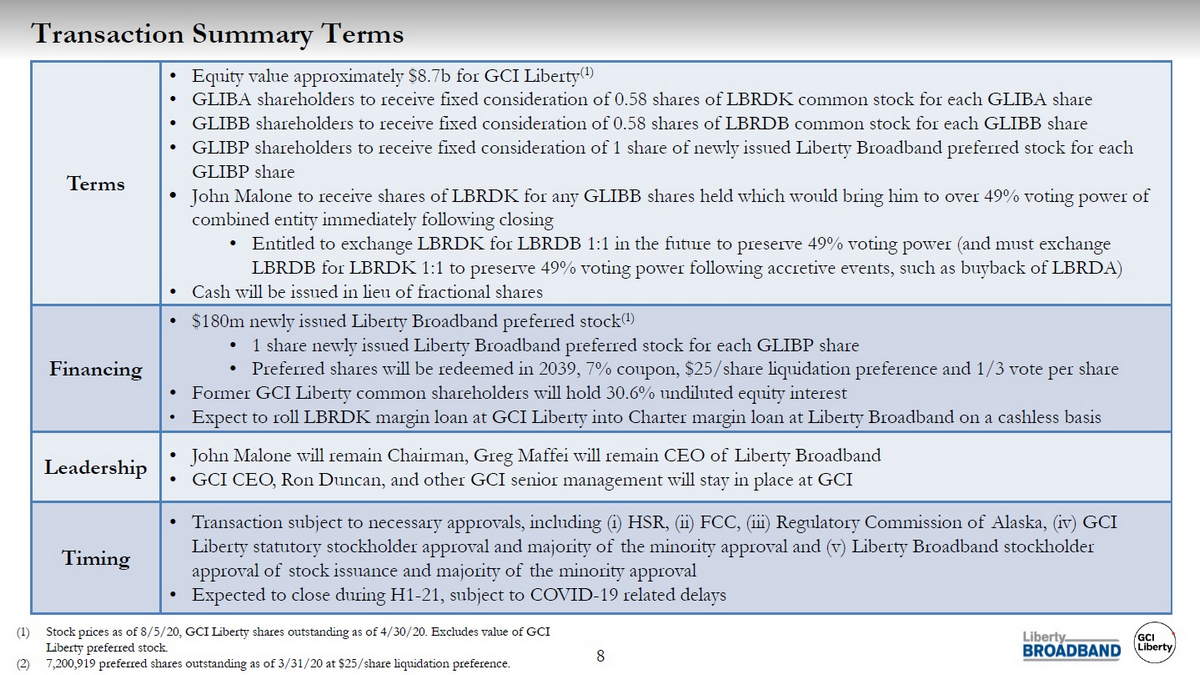

8 Transaction Summary Terms Terms • E quity value approximately $8.7b for GCI Liberty (1) • GLIBA shareholders to receive fixed consideration of 0.58 shares of LBRDK common stock for each GLIBA share • GLIBB shareholders to receive fixed consideration of 0.58 shares of LBRDB common stock for each GLIBB share • GLIBP shareholders to receive fixed consideration of 1 share of newly issued Liberty Broadband preferred stock for each GLIBP share • John Malone to receive shares of LBRDK for any GLIBB shares held which would bring him to over 49% voting power of combined entity immediately following closing • Entitled to exchange LBRDK for LBRDB 1:1 in the future to preserve 49% voting power (and must exchange LBRDB for LBRDK 1:1 to preserve 49% voting power following accretive events, such as buyback of LBRDA) • Cash will be issued in lieu of fractional shares Financing • $180m newly issued Liberty Broadband preferred stock (1) • 1 share newly issued Liberty Broadband preferred stock for each GLIBP share • Preferred shares will be redeemed in 2039 , 7% coupon, $25/share liquidation preference and 1/3 vote per share • Former GCI Liberty common shareholders will hold 30.6% undiluted equity interest • Expect to roll LBRDK margin loan at GCI Liberty into Charter margin loan at Liberty Broadband on a cashless basis Leadership • John Malone will remain Chairman, Greg Maffei will remain CEO of Liberty Broadband • GCI CEO, Ron Duncan, and other GCI senior management will stay in place at GCI Timing • Transaction subject to necessary approvals, including ( i ) HSR, (ii) FCC, (iii) Regulatory Commission of Alaska, (iv) GCI Liberty statutory stockholder approval and majority of the minority approval and (v) Liberty Broadband stockholder approval of stock issuance and majority of the minority approval • Expected to close during H1 - 21, subject to COVID - 19 related delays (1) Stock prices as of 8/5/20, GCI Liberty shares outstanding as of 4/30/20. Excludes value of GCI Liberty preferred stock. (2) 7,200,919 preferred shares outstanding as of 3/31/20 at $25/share liquidation preference.

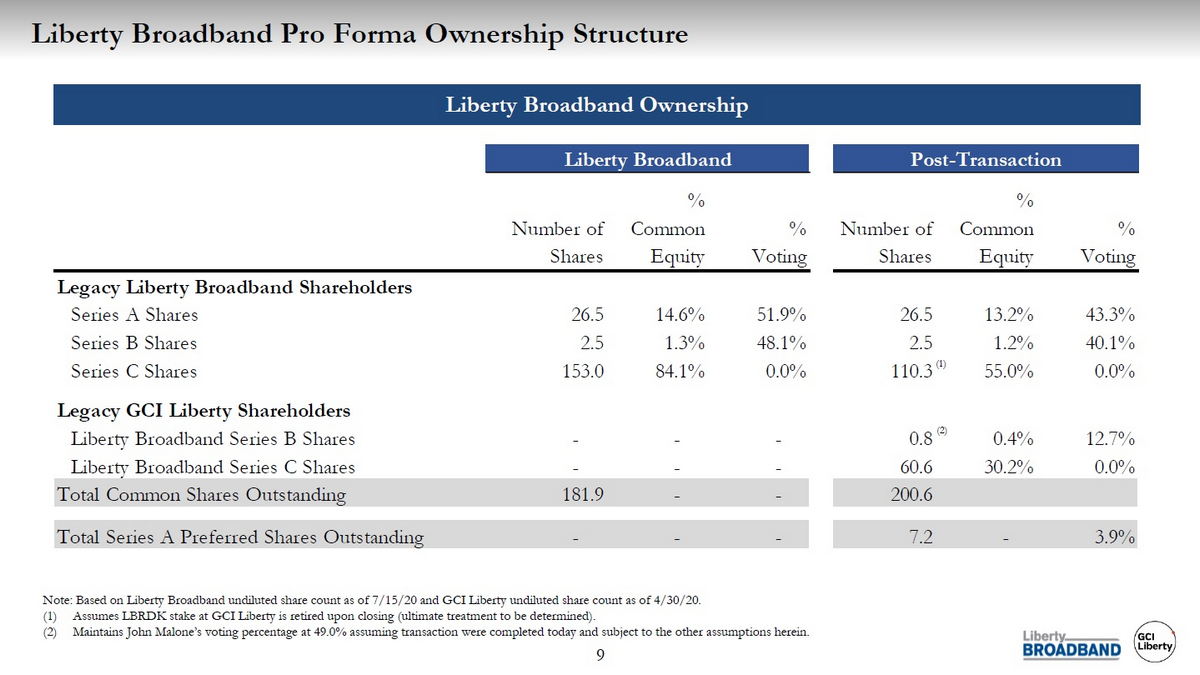

9 Number of Shares % Common Equity % Voting Number of Shares % Common Equity % Voting Legacy Liberty Broadband Shareholders Series A Shares 26.5 14.6% 51.9% 26.5 13.2% 43.3% Series B Shares 2.5 1.3% 48.1% 2.5 1.2% 40.1% Series C Shares 153.0 84.1% 0.0% 110.3 55.0% 0.0% Legacy GCI Liberty Shareholders Liberty Broadband Series B Shares - - - 0.8 0.4% 12.7% Liberty Broadband Series C Shares - - - 60.6 30.2% 0.0% Total Common Shares Outstanding 181.9 - - 200.6 Total Series A Preferred Shares Outstanding - - - 7.2 - 3.9% Liberty Broadband Post-Transaction Liberty Broadband Pro Forma Ownership Structure Liberty Broadband Ownership Note: Based on Liberty Broadband undiluted share count as of 7/15/20 and GCI Liberty undiluted share count as of 4/30/20. (1) Assumes LBRDK stake at GCI Liberty is retired upon closing (ultimate treatment to be determined). (2) Maintains John Malone’s voting percentage at 49.0% assuming transaction were completed today and subject to the other assumpt ion s herein. (1) (2)

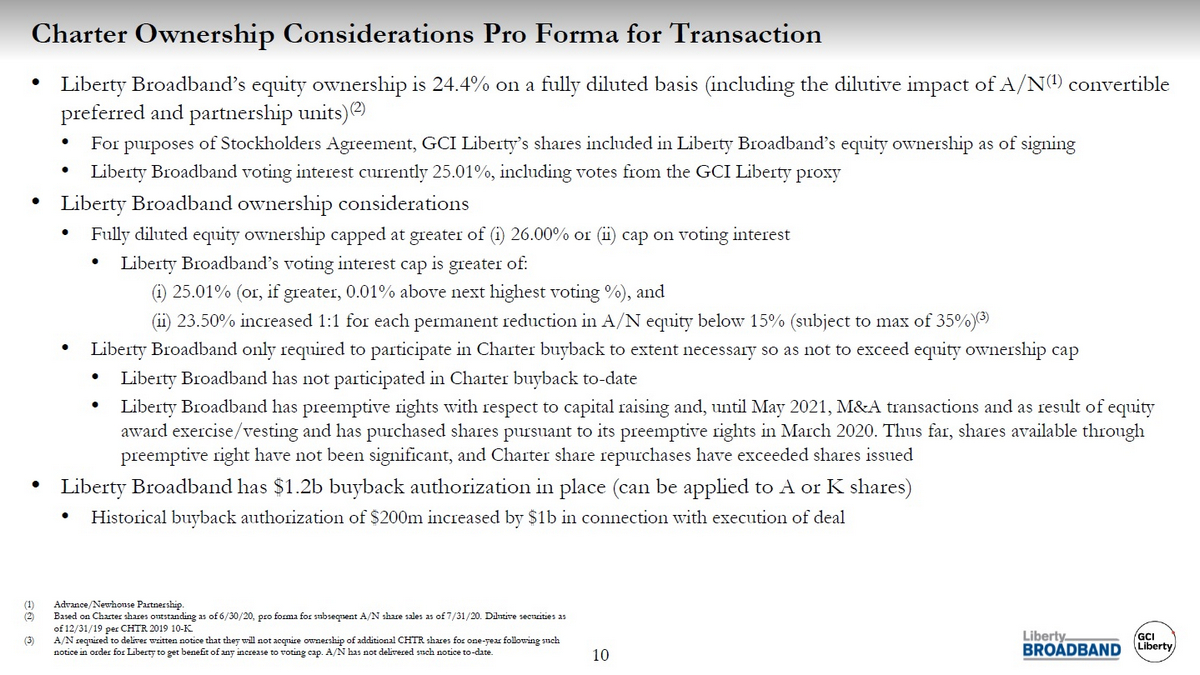

10 Charter Ownership Considerations Pro Forma for Transaction • Liberty Broadband’s equity ownership is 24.4% on a fully diluted basis (including the dilutive impact of A/N (1) convertible preferred and partnership units) (2) • For purposes of Stockholders Agreement, GCI Liberty’s shares included in Liberty Broadband’s equity ownership as of signing • Liberty Broadband voting interest currently 25.01%, including votes from the GCI Liberty proxy • Liberty Broadband ownership considerations • Fully diluted equity ownership capped at greater of ( i ) 26.00% or (ii) cap on voting interest • Liberty Broadband’s voting interest cap is greater of: ( i ) 25.01% (or, if greater, 0.01% above next highest voting %), and (ii) 23.50% increased 1:1 for each permanent reduction in A/N equity below 15% (subject to max of 35%) (3) • Liberty Broadband only required to participate in Charter buyback to extent necessary so as not to exceed equity ownership ca p • Liberty Broadband has not participated in Charter buyback to - date • Liberty Broadband has preemptive rights with respect to capital raising and, until May 2021, M&A transactions and as result o f e quity award exercise/vesting and has purchased shares pursuant to its preemptive rights in March 2020. Thus far, shares available t hro ugh preemptive right have not been significant, and Charter share repurchases have exceeded shares issued • Liberty Broadband has $1.2b buyback authorization in place (can be applied to A or K shares) • Historical buyback authorization of $200m increased by $1b in connection with execution of deal (1) Advance/Newhouse Partnership. (2) Based on Charter shares outstanding as of 6/30/20, pro forma for subsequent A/N share sales as of 7/31/20. Dilutive securitie s a s of 12/31/19 per CHTR 2019 10 - K. (3) A/N required to deliver written notice that they will not acquire ownership of additional CHTR shares for one - year following suc h notice in order for Liberty to get benefit of any increase to voting cap. A/N has not delivered such notice to - date.

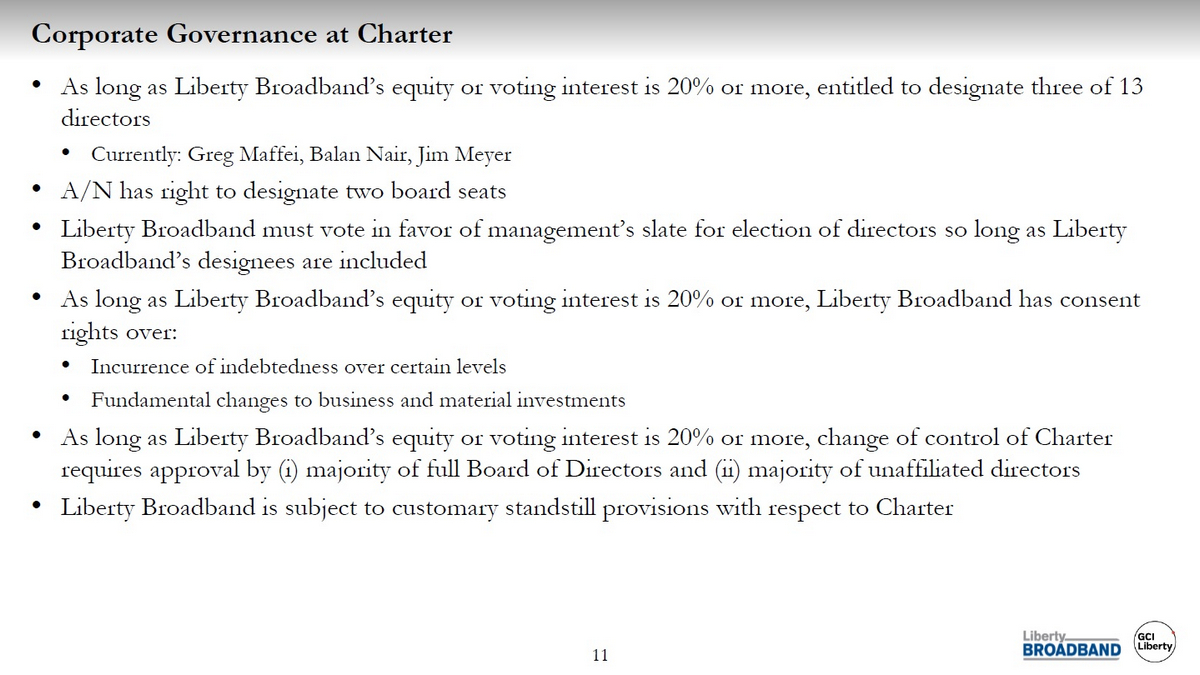

11 Corporate Governance at Charter • As long as Liberty Broadband’s equity or voting interest is 20% or more, entitled to designate three of 13 directors • Currently: Greg Maffei, Balan Nair, Jim Meyer • A/N has right to designate two board seats • Liberty Broadband must vote in favor of management’s slate for election of directors so long as Liberty Broadband’s designees are included • As long as Liberty Broadband’s equity or voting interest is 20% or more, Liberty Broadband has consent rights over: • Incurrence of indebtedness over certain levels • Fundamental changes to business and material investments • As long as Liberty Broadband’s equity or voting interest is 20% or more, change of control of Charter requires approval by ( i ) majority of full Board of Directors and (ii) majority of unaffiliated directors • Liberty Broadband is subject to customary standstill provisions with respect to Charter

12 A/N Proxy Considerations • A/N granted Liberty Broadband 5 - year irrevocable proxy to vote number of shares necessary to bring voting power to 25.01%, subject to cap of 7% • A/N has been selling into Charter buybacks; current diluted ownership approximately 12% (1) • A/N Proxy covers election of directors and other routine stockholder matters, but not extraordinary matters (such as vote on Charter change in control transaction) • Subject to certain exceptions, Liberty Broadband has right of first refusal to purchase at market price Charter shares that A/N proposes to sell • Such purchases subject to Liberty Broadband not exceeding voting or ownership cap after giving effect to acquisition • Has not purchased any shares sold by A/N to - date • A/N proxy terminates on first to occur of: • 5 - year anniversary of Charter - TWC closing (5/18/2021) • Liberty Broadband: • Becoming required to register as investment company • Material breach of contract (subject to certain cure rights) • Change of control • Transaction resulting in change in majority of Board members over 2 - year period or Liberty Broadband stockholders no longer owni ng at least 50% of equity and voting power of Liberty Broadband or successor entity, excluding ( i ) acquisition of control by one or more Liberty Broadband persons or (ii) a combination with another entity controlled by a “Liberty Person” (defined in Stockholders Agreement) • As to A/N Proxy only: certain transfers of Charter shares by Liberty Broadband, including if Liberty Broadband’s equity interest goes below 17.01% (1) Based on Charter shares outstanding as of 6/30/20, pro forma for subsequent A/N share sales as of 7/31/20. Dilutive securities as of 12/31/19 per CHTR 2019 10 - K.

13 Restrictions on Charter Share Sales Pro Forma for Transaction • Customary restrictions on share sales, transfers or disposals. Liberty Broadband may only transfer shares in the following manner: • Underwritten public offering • Rule 144/144A • Certain block sales (so long as transferee would not own 5% or more of Charter shares after giving effect to transfer) • Sales between Liberty Broadband and A/N (including pursuant to Liberty Broadband’s ROFR on A/N sales) at market prices and transfers among A/N affiliated entities and transfers among Liberty Broadband affiliated entities • Transfers approved by majority of unaffiliated directors on Charter Board or unaffiliated stockholders • Sale into tender offer for all Charter equity • Exceptions to transfer restrictions permit Liberty Broadband to: • Engage in certain financing and derivative transactions with respect to Charter shares • Transfer shares in connection with spinoff (along with obligations/benefits under Stockholders Agreement)