Exhibit (c)(8)

|

Confidential Presentation to the Special Committee June 23, 2020 |

|

Confidential These materials have been prepared by Evercore Group L.L.C. (“Evercore”) for the Special Committee of the Board of Directors (the “Committee”) of GCI Liberty, Inc. (“GLIB” or the “Company”) to whom such materials are directly addressed and delivered and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Evercore. These materials are based on information provided by or on behalf of the Committee, including from Company management, and/or other potential transaction participants, or from public sources or otherwise reviewed by Evercore. Evercore assumes no responsibility for independent investigation or verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance prepared by or reviewed with the management of the Company and/or other potential transaction participants or obtained from public sources, Evercore has assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such management (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. These materials were designed for use by specific persons familiar with the business and affairs of the Company. These materials are not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any transaction or other matter. These materials have been developed by and are proprietary to Evercore and were prepared exclusively for the benefit and internal use of the Committee. These materials were compiled on a confidential basis for use by the Committee in evaluating the potential transaction described herein and not with a view to public disclosure or filing thereof under state or federal securities laws, and may not be reproduced, disseminated, quoted or referred to, in whole or in part, without the prior written consent of Evercore. These materials do not constitute an offer or solicitation to sell or purchase any securities and are not a commitment by Evercore (or any affiliate) to provide or arrange any financing for any transaction or to purchase any security in connection therewith. Evercore assumes no obligation to update or otherwise revise these materials. These materials may not reflect information known to other professionals in other business areas of Evercore and its affiliates. Evercore and its affiliates do not provide legal, accounting or tax advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by Evercore or its affiliates to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. Each person should seek legal, accounting and tax advice based on his, her or its particular circumstances from independent advisors regarding the impact of the transactions or matters described herein. 1 |

|

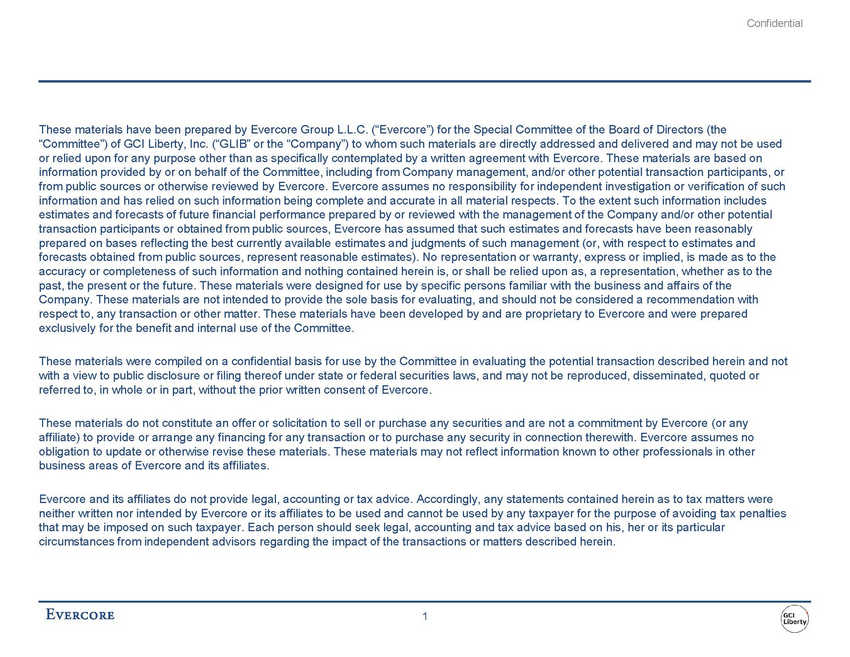

Confidential Summary of Liberty Broadband’s Proposal to GCI Liberty Proposal was received on 6/22/20 Terms Details 0.575 Liberty Broadband (LBRD) Series C shares (non-voting) for each GCI Liberty (GLIB) Series A and Series B (voting) share held LBRD Series C Common Shares (non-voting) $74.38/share for each GLIB Series A or Series B (voting) share based on LBRD Series C (non-voting) closing price of $129.36 on 6/22/20 Implies a 8.4% premium to GLIB Series A shareholders, based on GLIB Series A closing price of $68.63 as of 6/22/20 Implies a 8.2% premium to Series B shareholders, based on GLIB Series B closing price of $68.75 as of 6/22/20 (Average daily trading volume of less than 100 shares) Aggregate premium to GLIB series A shareholders on a fully diluted basis of $623mm or $5.75 per GLIBA share Rollover into a Liberty Broadband preferred instrument with same terms No conversion rights; voting rights with common (1/3 of a vote / share) Dividends, payable quarterly, accrue on a daily basis at a rate of 7.00% per annum If GCI Liberty fails to pay dividend for any four quarterly periods, dividend rate increases by 2% annual rate until cured Mandatory redemption date of March, 2039 2 GLIB Series A Cumulative Redeemable Preferred Stock Implied Premium Implied Price Form of Consideration Exchange Ratio |

|

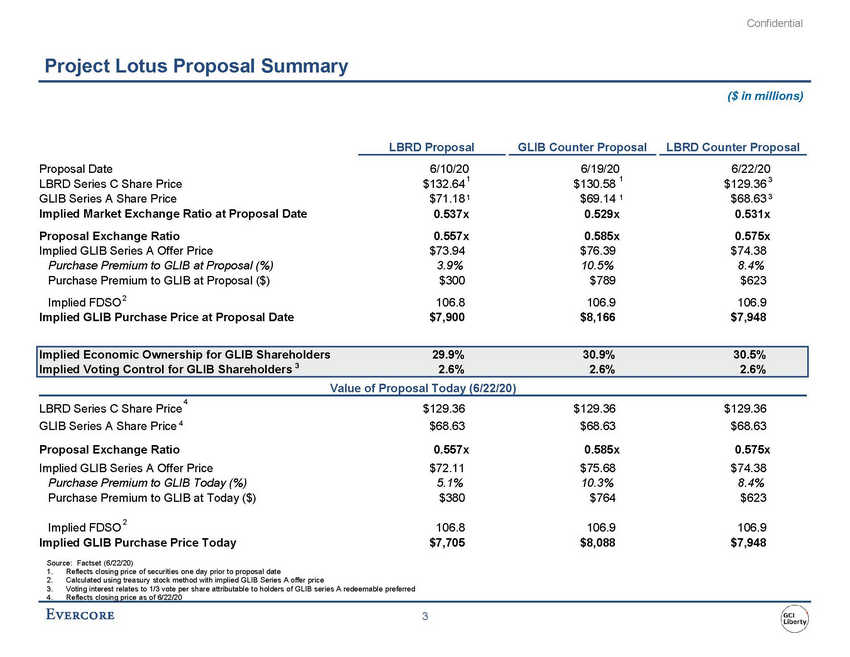

Confidential Project Lotus Proposal Summary ($ in millions) LBRD Proposal GLIB Counter Proposal LBRD Counter Proposal Proposal Date LBRD Series C Share Price GLIB Series A Share Price Implied Market Exchange Ratio at Proposal Date Proposal Exchange Ratio Implied GLIB Series A Offer Price Purchase Premium to GLIB at Proposal (%) Purchase Premium to GLIB at Proposal ($) Implied FDSO 2 Implied GLIB Purchase Price at Proposal Date 6/10/20 $132.64 1 $71.18 1 0.537x 0.557x $73.94 3.9% $300 106.8 $7,900 6/19/20 $130.58 1 $69.14 1 0.529x 0.585x $76.39 10.5% $789 106.9 $8,166 6/22/20 $129.36 3 $68.63 3 0.531x 0.575x $74.38 8.4% $623 106.9 $7,948 Value of Proposal Today (6/22/20) 4 LBRD Series C Share Price $129.36 $68.63 0.557x $72.11 5.1% $380 $129.36 $68.63 0.585x $75.68 10.3% $764 $129.36 $68.63 0.575x $74.38 8.4% $623 GLIB Series A Share Price 4 Proposal Exchange Ratio Implied GLIB Series A Offer Price Purchase Premium to GLIB Today (%) Purchase Premium to GLIB at Today ($) 2 Implied FDSO 106.8 $7,705 106.9 $8,088 106.9 $7,948 Implied GLIB Purchase Price Today Source: Factset (6/22/20) 1. 2. 3. Reflects closing price of securities one day prior to proposal date Calculated using treasury stock method with implied GLIB Series A offer price Voting interest relates to 1/3 vote per share attributable to holders of GLIB series A redeemable preferred 4. Reflects closing price as of 6/22/20 3 Implied Economic Ownership for GLIB Shareholders 29.9% 30.9% 30.5% Implied Voting Control for GLIB Shareholders 32.6% 2.6% 2.6% |

|

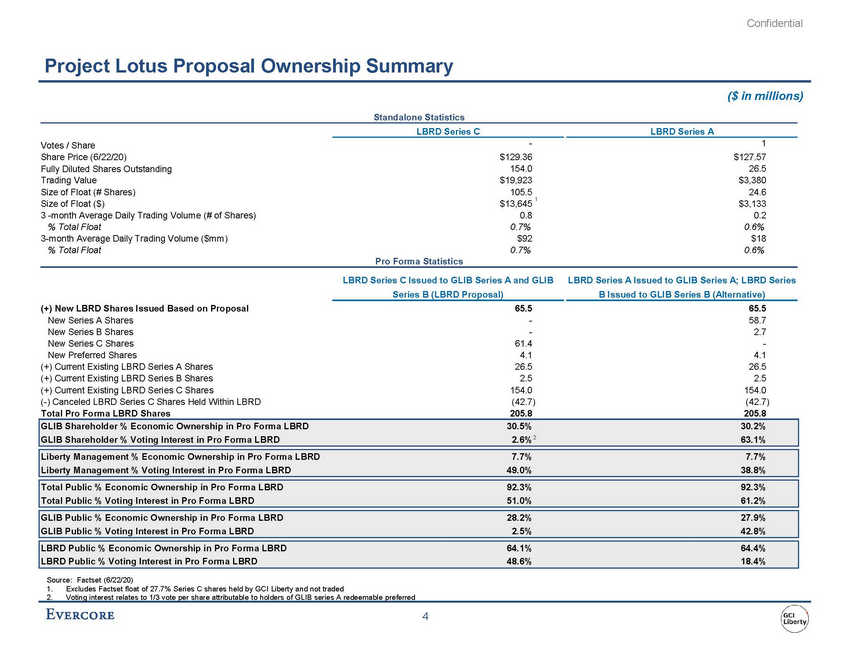

Confidential Project Lotus Proposal Ownership Summary ($ in millions) Standalone Statistics LBRD Series C LBRD Series A - $129.36 154.0 $19,923 105.5 $13,645 0.8 0.7% $92 0.7% 1 $127.57 26.5 $3,380 24.6 $3,133 0.2 0.6% $18 0.6% Votes / Share Share Price (6/22/20) Fully Diluted Shares Outstanding Trading Value Size of Float (# Shares) Size of Float ($) 3 -month Average Daily Trading Volume (# of Shares) % Total Float 3-month Average Daily Trading Volume ($mm) % Total Float 1 Pro Forma Statistics LBRD Series C Issued to GLIB Series A and GLIB LBRD Series A Issued to GLIB Series A; LBRD Series Series B (LBRD Proposal) B Issued to GLIB Series B (Alternative) (+) New LBRD Shares Issued Based on Proposal New Series A Shares New Series B Shares New Series C Shares New Preferred Shares (+) Current Existing LBRD Series A Shares (+) Current Existing LBRD Series B Shares (+) Current Existing LBRD Series C Shares (-) Canceled LBRD Series C Shares Held Within LBRD Total Pro Forma LBRD Shares 65.5 - - 61.4 4.1 26.5 2.5 154.0 (42.7) 205.8 65.5 58.7 2.7 - 4.1 26.5 2.5 154.0 (42.7) 205.8 Source: Factset (6/22/20) 1. Excludes Factset float of 27.7% Series C shares held by GCI Liberty and not traded 2. Voting interest relates to 1/3 vote per share attributable to holders of GLIB series A redeemable preferred 4 GLIB Shareholder % Economic Ownership in Pro Forma LBRD30.5%30.2% GLIB Shareholder % Voting Interest in Pro Forma LBRD2.6%263.1% Liberty Management % Economic Ownership in Pro Forma LBRD7.7% 7.7% Liberty Management % Voting Interest in Pro Forma LBRD49.0%38.8% Total Public % Economic Ownership in Pro Forma LBRD92.3%92.3% Total Public % Voting Interest in Pro Forma LBRD51.0%61.2% GLIB Public % Economic Ownership in Pro Forma LBRD28.2%27.9% GLIB Public % Voting Interest in Pro Forma LBRD2.5%42.8% LBRD Public % Economic Ownership in Pro Forma LBRD64.1%64.4% LBRD Public % Voting Interest in Pro Forma LBRD48.6%18.4% |

|

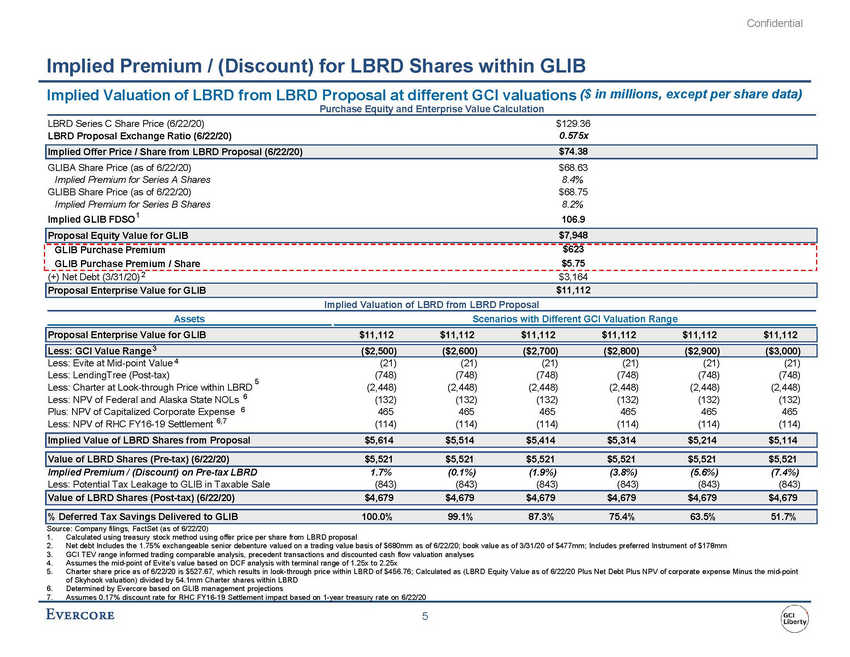

Confidential Implied Premium / (Discount) for LBRD Shares within GLIB Implied Valuation of LBRD from LBRD Proposal at different GCI valuations ($ in millions, except per share data) Purchase Equity and Enterprise Value Calculation LBRD Series C Share Price (6/22/20) LBRD Proposal Exchange Ratio (6/22/20) $129.36 0.575x GLIBA Share Price (as of 6/22/20) Implied Premium for Series A Shares GLIBB Share Price (as of 6/22/20) Implied Premium for Series B Shares Implied GLIB FDSO 1 $68.63 8.4% $68.75 8.2% 106.9 (+) Net Debt (3/31/20) 2 $3,164 Implied Valuation of LBRD from LBRD Proposal Assets Scenarios with Different GCI Valuation Range Less: Evite at Mid-point Value 4 Less: LendingTree (Post-tax) Less: Charter at Look-through Price within LBRD Less: NPV of Federal and Alaska State NOLs 6 (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) 5 6 Plus: NPV of Capitalized Corporate Expense Less: NPV of RHC FY16-19 Settlement 6,7 Implied Premium / (Discount) on Pre-tax LBRD Less: Potential Tax Leakage to GLIB in Taxable Sale 1.7% (843) (0.1%) (843) (1.9%) (843) (3.8%) (843) (5.6%) (843) (7.4%) (843) Source: Company filings, FactSet (as of 6/22/20) 1. 2. 3. 4. 5. Calculated using treasury stock method using offer price per share from LBRD proposal Net debt Includes the 1.75% exchangeable senior debenture valued on a trading value basis of $680mm as of 6/22/20; book value as of 3/31/20 of $477mm; Includes preferred Instrument of $178mm GCI TEV range informed trading comparable analysis, precedent transactions and discounted cash flow valuation analyses Assumes the mid-point of Evite’s value based on DCF analysis with terminal range of 1.25x to 2.25x Charter share price as of 6/22/20 is $527.67, which results in look-through price within LBRD of $456.76; Calculated as (LBRD Equity Value as of 6/22/20 Plus Net Debt Plus NPV of corporate expense Minus the mid-point of Skyhook valuation) divided by 54.1mm Charter shares within LBRD Determined by Evercore based on GLIB management projections 6. 7. Assumes 0.17% discount rate for RHC FY16-19 Settlement impact based on 1-year treasury rate on 6/22/20 5 Value of LBRD Shares (Post-tax) (6/22/20) $4,679 $4,679 $4,679 $4,679 $4,679 $4,679 % Deferred Tax Savings Delivered to GLIB 100.0% 99.1% 87.3% 75.4% 63.5% 51.7% Implied Value of LBRD Shares from Proposal $5,614 $5,514 $5,414 $5,314 $5,214 $5,114 Value of LBRD Shares (Pre-tax) (6/22/20) $5,521 $5,521 $5,521 $5,521 $5,521 $5,521 Proposal Enterprise Value for GLIB $11,112 $11,112 $11,112 $11,112 $11,112 $11,112 Less: GCI Value Range 3($2,500) ($2,600) ($2,700) ($2,800) ($2,900) ($3,000) Proposal Enterprise Value for GLIB $11,112 Proposal Equity Value for GLIB $7,948 GLIB Purchase Premium $623 GLIB Purchase Premium / Share $5.75 Implied Offer Price / Share from LBRD Proposal (6/22/20) $74.38 |

|

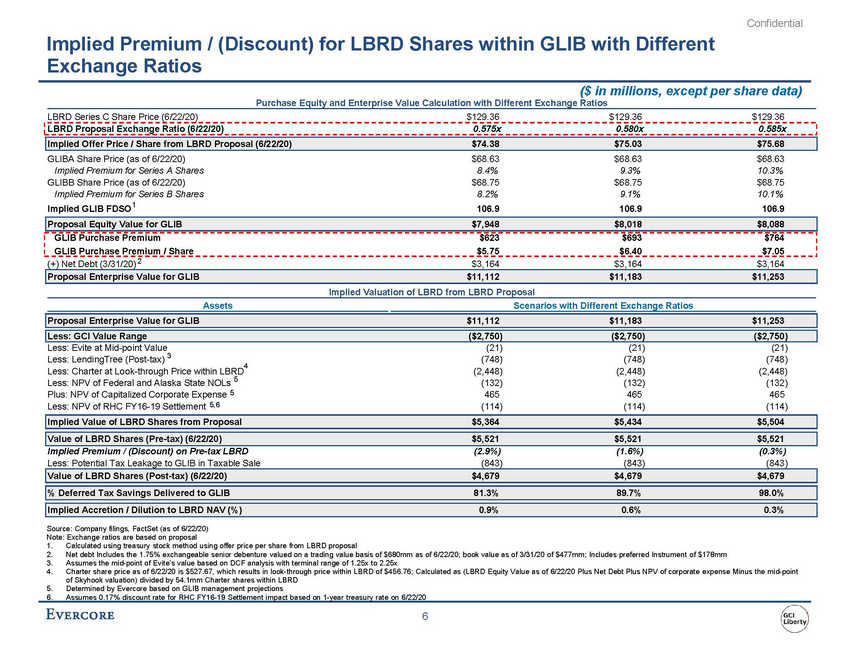

Confidential Implied Premium / (Discount) for LBRD Shares within GLIB with Different Exchange Ratios ($ in millions, except per share data) Purchase Equity and Enterprise Value Calculation with Different Exchange Ratios LBRD Series C Share Price (6/22/20) $129.36 $129.36 $129.36 GLIBA Share Price (as of 6/22/20) Implied Premium for Series A Shares GLIBB Share Price (as of 6/22/20) Implied Premium for Series B Shares Implied GLIB FDSO1 $68.63 8.4% $68.75 8.2% 106.9 $68.63 9.3% $68.75 9.1% 106.9 $68.63 10.3% $68.75 10.1% 106.9 (+) Net Debt (3/31/20) 2 $3,164 $3,164 $3,164 Implied Valuation of LBRD from LBRD Proposal Assets Scenarios with Different Exchange Ratios Less: Evite at Mid-point Value Less: LendingTree (Post-tax) 3 (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) 4 Less: Charter at Look-through Price within LBRD Less: NPV of Federal and Alaska State NOLs 5 Plus: NPV of Capitalized Corporate Expense 5 Less: NPV of RHC FY16-19 Settlement 5,6 Implied Premium / (Discount) on Pre-tax LBRD Less: Potential Tax Leakage to GLIB in Taxable Sale (2.9%) (843) (1.6%) (843) (0.3%) (843) Source: Company filings, FactSet (as of 6/22/20) Note: Exchange ratios are based on proposal 1. 2. 3. 4. Calculated using treasury stock method using offer price per share from LBRD proposal Net debt Includes the 1.75% exchangeable senior debenture valued on a trading value basis of $680mm as of 6/22/20; book value as of 3/31/20 of $477mm; Includes preferred Instrument of $178mm Assumes the mid-point of Evite’s value based on DCF analysis with terminal range of 1.25x to 2.25x Charter share price as of 6/22/20 is $527.67, which results in look-through price within LBRD of $456.76; Calculated as (LBRD Equity Value as of 6/22/20 Plus Net Debt Plus NPV of corporate expense Minus the mid-point of Skyhook valuation) divided by 54.1mm Charter shares within LBRD Determined by Evercore based on GLIB management projections 5. 6. Assumes 0.17% discount rate for RHC FY16-19 Settlement impact based on 1-year treasury rate on 6/22/20 6 Value of LBRD Shares (Post-tax) (6/22/20)$4,679$4,679$4,679 % Deferred Tax Savings Delivered to GLIB81.3%89.7%98.0% Implied Accretion / Dilution to LBRD NAV (%)0.9%0.6%0.3% Implied Value of LBRD Shares from Proposal$5,364$5,434$5,504 Value of LBRD Shares (Pre-tax) (6/22/20)$5,521$5,521$5,521 Proposal Enterprise Value for GLIB$11,112$11,183$11,253 Less: GCI Value Range($2,750)($2,750)($2,750) Proposal Enterprise Value for GLIB$11,112$11,183$11,253 Proposal Equity Value for GLIB$7,948$8,018$8,088 GLIB Purchase Premium$623$693$764 GLIB Purchase Premium / Share$5.75$6.40$7.05 LBRD Proposal Exchange Ratio (6/22/20)0.575x0.580x0.585x Implied Offer Price / Share from LBRD Proposal (6/22/20)$74.38$75.03$75.68 |

|

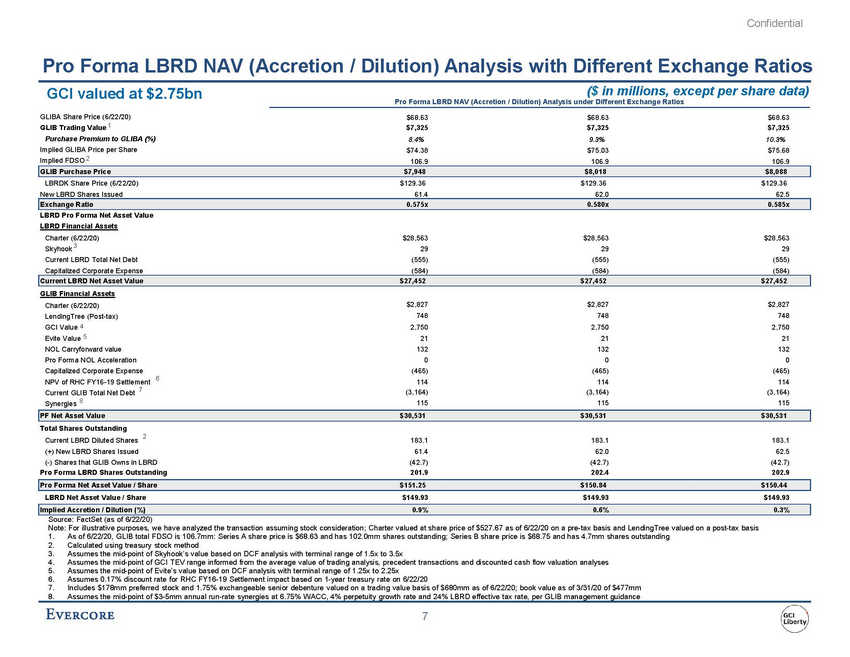

Confidential Pro Forma LBRD NAV (Accretion / Dilution) Analysis with Different Exchange Ratios ($ in millions, except per share data) Pro Forma LBRD NAV (Accretion / Dilution) Analysis under Different Exchange Ratios GCI valued at $2.75bn GLIBA Share Price (6/22/20) GLIB Trading Value 1 Purchase Premium to GLIBA (%) Implied GLIBA Price per Share Implied FDSO 2 $68.63 $7,325 8.4% $74.38 106.9 $68.63 $7,325 9.3% $75.03 106.9 $68.63 $7,325 10.3% $75.68 106.9 LBRDK Share Price (6/22/20) New LBRD Shares Issued $129.36 61.4 $129.36 62.0 $129.36 62.5 LBRD Pro Forma Net Asset Value LBRD Financial Assets Charter (6/22/20) Skyhook 3 Current LBRD Total Net Debt Capitalized Corporate Expense $28,563 29 (555) (584) $28,563 29 (555) (584) $28,563 29 (555) (584) GLIB Financial Assets Charter (6/22/20) LendingTree (Post-tax) GCI Value 4 Evite Value 5 NOL Carryforward value Pro Forma NOL Acceleration Capitalized Corporate Expense NPV of RHC FY16-19 Settlement Current GLIB Total Net Debt 7 Synergies 8 $2,827 748 2,750 21 132 0 (465) 114 (3,164) 115 $2,827 748 2,750 21 132 0 (465) 114 (3,164) 115 $2,827 748 2,750 21 132 0 (465) 114 (3,164) 115 6 Total Shares Outstanding Current LBRD Diluted Shares 2 (+) New LBRD Shares Issued (-) Shares that GLIB Owns in LBRD Pro Forma LBRD Shares Outstanding 183.1 61.4 (42.7) 201.9 183.1 62.0 (42.7) 202.4 183.1 62.5 (42.7) 202.9 LBRD Net Asset Value / Share $149.93 $149.93 $149.93 Source: FactSet (as of 6/22/20) Note: For illustrative purposes, we have analyzed the transaction assuming stock consideration; Charter valued at share price of $527.67 as of 6/22/20 on a pre-tax basis and LendingTree valued on a post-tax basis 1. 2. 3. 4. 5. 6. 7. 8. As of 6/22/20, GLIB total FDSO is 106.7mm: Series A share price is $68.63 and has 102.0mm shares outstanding; Series B share price is $68.75 and has 4.7mm shares outstanding Calculated using treasury stock method Assumes the mid-point of Skyhook’s value based on DCF analysis with terminal range of 1.5x to 3.5x Assumes the mid-point of GCI TEV range informed from the average value of trading analysis, precedent transactions and discounted cash flow valuation analyses Assumes the mid-point of Evite’s value based on DCF analysis with terminal range of 1.25x to 2.25x Assumes 0.17% discount rate for RHC FY16-19 Settlement impact based on 1-year treasury rate on 6/22/20 Includes $178mm preferred stock and 1.75% exchangeable senior debenture valued on a trading value basis of $680mm as of 6/22/20; book value as of 3/31/20 of $477mm Assumes the mid-point of $3-5mm annual run-rate synergies at 6.75% WACC, 4% perpetuity growth rate and 24% LBRD effective tax rate, per GLIB management guidance 7 Implied Accretion / Dilution (%) 0.9% 0.6% 0.3% Pro Forma Net Asset Value / Share $151.25 $150.84 $150.44 PF Net Asset Value $30,531 $30,531 $30,531 Current LBRD Net Asset Value $27,452 $27,452 $27,452 Exchange Ratio 0.575x 0.580x 0.585x GLIB Purchase Price $7,948 $8,018 $8,088 |

|

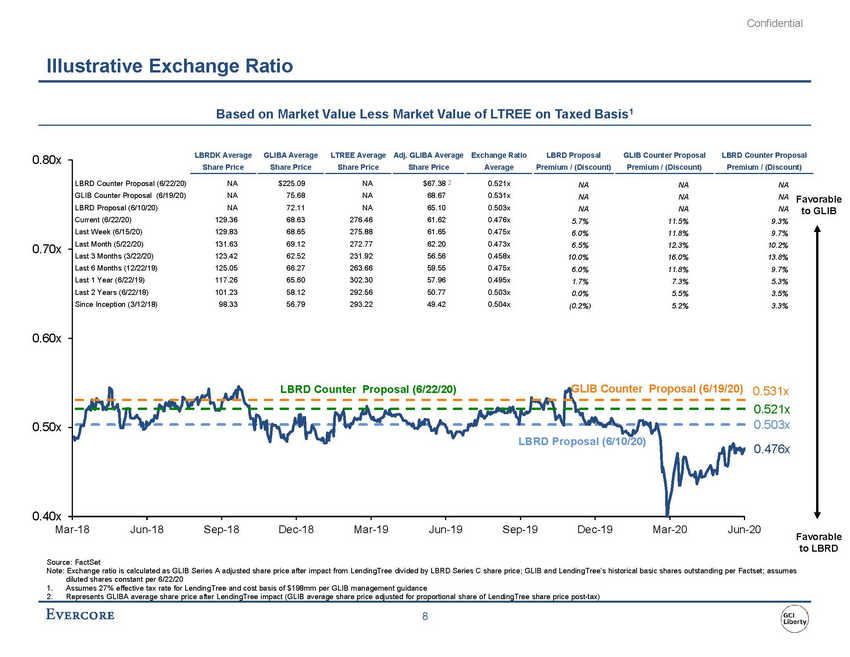

Confidential Illustrative Exchange Ratio Based on Market Value Less Market Value of LTREE on Taxed Basis1 LBRDK Average GLIBA Average LTREE Average Adj. GLIBA Average Exchange Ratio LBRD Proposal GLIB Counter Proposal LBRD Counter Proposal 0.80x ium / (Discount) NA NA NA 9.3% 9.7% 10.2% 13.8% 9.7% 5.3% 3.5% 3.3% Favorable to GLIB 0.70x 0.60x 0.531x 0.521x 0.503x 0.476x 0.50x 0.40x Mar-18 Jun-18 Sep-18 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Favorable to LBRD Source: FactSet Note: Exchange ratio is calculated as GLIB Series A adjusted share price after impact from LendingTree divided by LBRD Series C share price; GLIB and LendingTree’s historical basic shares outstanding per Factset; assumes diluted shares constant per 6/22/20 1. 2. Assumes 27% effective tax rate for LendingTree and cost basis of $198mm per GLIB management guidance Represents GLIBA average share price after LendingTree impact (GLIB average share price adjusted for proportional share of LendingTree share price post-tax) 8 Share PriceShare PriceShare PriceShare PriceAveragePremium / (Discount)Premium / (Discount)Prem LBRD Counter Proposal (6/22/20) NA $225.09 NA $67.38 2 0.521x NA NA GLIB Counter Proposal (6/19/20) NA 75.68 NA 68.67 0.531x NA NA LBRD Proposal (6/10/20) NA 72.11 NA 65.10 0.503x NA NA Current (6/22/20) 129.36 68.63 276.46 61.62 0.476x 5.7% 11.5% Last Week (6/15/20) 129.83 68.65 275.88 61.65 0.475x 6.0% 11.8% Last Month (5/22/20) 131.63 69.12 272.77 62.20 0.473x 6.5% 12.3% Last 3 Months (3/22/20) 123.42 62.52 231.92 56.56 0.458x 10.0% 16.0% Last 6 Months (12/22/19) 125.05 66.27 263.66 59.55 0.475x 6.0% 11.8% Last 1 Year (6/22/19) 117.26 65.60 302.30 57.96 0.495x 1.7% 7.3% Last 2 Years (6/22/18) 101.23 58.12 292.56 50.77 0.503x 0.0% 5.5% Since Inception (3/12/18) 98.33 56.79 293.22 49.42 0.504x (0.2%) 5.2% LBRD Counter Proposal (6/22/20) GLIB Counter Proposal (6/19/20) LBRD Proposal (6/10/20) |

|

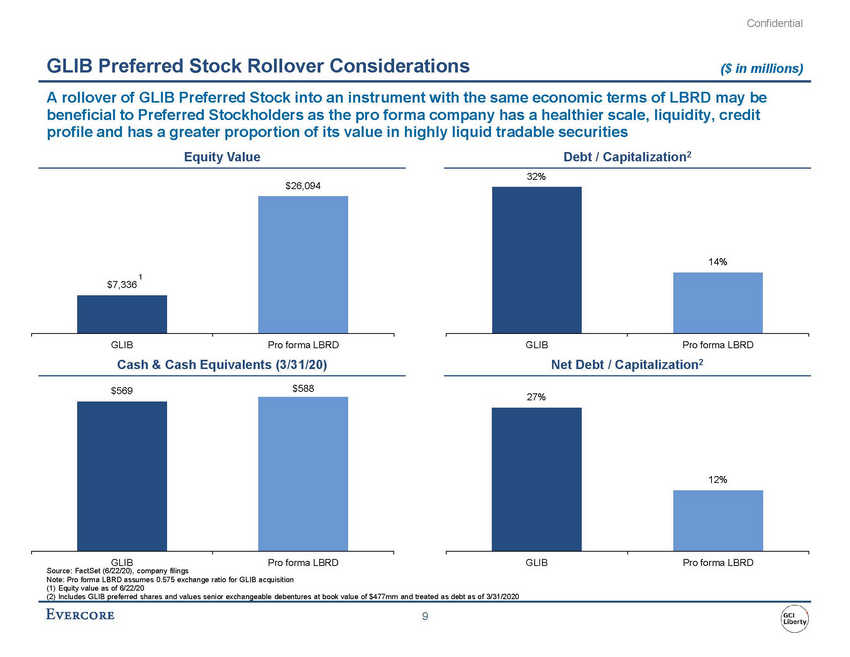

Confidential GLIB Preferred Stock Rollover Considerations ($ in millions) A rollover of GLIB Preferred Stock into an instrument with the same economic terms of LBRD may be beneficial to Preferred Stockholders as the pro forma company has a healthier scale, liquidity, credit profile and has a greater proportion of its value in highly liquid tradable securities Equity Value Debt / Capitalization2 32% $26,094 $7,336 GLIB Pro forma LBRD GLIB Pro forma LBRD Net Debt / Capitalization2 Cash & Cash Equivalents (3/31/20) $588 $569 27% GLIB Pro forma LBRD GLIB Pro forma LBRD Source: FactSet (6/22/20), company filings Note: Pro forma LBRD assumes 0.575 exchange ratio for GLIB acquisition (1) Equity value as of 6/22/20 (2) Includes GLIB preferred shares and values senior exchangeable debentures at book value of $477mm and treated as debt as of 3/31/2020 9 12% 1 14% |