Via EDGAR

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

Attention: Larry Spirgel, Assistant Director

Re: Liberty Broadband Corporation

Form 10-K for the Fiscal Year Ended December 31, 2015

Filed February 12, 2016

File No. 001-36713

Dear Mr. Spirgel,

Set forth below is the response to the comment contained in your letter to Gregory B. Maffei, President and Chief Executive Officer of Liberty Broadband Corporation (“Broadband”), dated August 12, 2016, regarding the Liberty Form 10-K for the fiscal year ended December 31, 2015 (the “Form 10-K”). For your convenience, our response below is preceded by the Staff’s comment. All section references refer to the corresponding sections of the Form 10-K unless otherwise noted, and all page references in our responses are to the pages in the Form 10-K.

***

Form 10-K for Fiscal Year Ended December 31, 2015

Risk Factors, page I-25

|

1. |

Comment: We note your disclosure that you do not believe you are an investment company under the Investment Company Act of 1940 (“1940 Act”) and plan to conduct your activities so you will not be deemed to be an investment company. We also note that in your prior response dated September 12, 2014, you provided an analysis as to why, pursuant to Rule 3a-1 under the 1940 Act, Liberty Media Corporation and Liberty Broadband Corporation (“Broadband”) do not believe that Broadband will be deemed an investment company under the 1940 Act. Please provide us with an updated analysis as to why you continue to believe you are not an investment company under the 1940 Act. In your response please discuss any material changes since the time of your last response that would affect your analysis. |

1

August 31, 2016

Response: Pursuant to Rule 3a-1 under the Investment Company Act of 1940, as amended (the “Act”), Broadband continues to believe that it should not be deemed an investment company under the Act. Rule 3a-1 provides that an issuer will not be deemed an investment company, notwithstanding Section 3(a)(1)(C) of the Act, if no more than 45% of the value of its total assets (exclusive of Government securities and cash items) consists of, and no more than 45% of its net income after taxes (for the last four fiscal quarters combined) is derived from, securities other than:

|

(1) |

Government securities; |

|

(2) |

securities issued by employees’ securities companies; |

|

(3) |

securities issued by majority-owned subsidiaries of the issuer (other than subsidiaries relying on the exclusion from the definition of investment company in Section 3(b)(3) or Section 3(c)(1) of the Act) which are not investment companies; and |

|

(4) |

securities issued by companies: |

|

(i) |

which are controlled primarily by such issuer; |

|

(ii) |

through which such issuer engages in a business other than that of investing reinvesting, owning, holding or trading in securities; and |

|

(iii) |

which are not investment companies. |

The percentages described by the rule must be calculated on an unconsolidated basis, except that the issuer can consolidate its financial statements with those of a wholly-owned subsidiary of the issuer. In addition, the issuer must not be an investment company under Sections 3(a)(1)(A) or 3(a)(1)(B) of the Act. Thus, under Rule 3a-1, if 55% or more of the value of an issuer’s total assets (exclusive of Government securities and cash items) consists of, and 55% or more of the issuer’s net income after taxes (for the last four fiscal quarters combined) is derived from, securities described in (1), (2), (3), or (4) above, then such issuer would not be deemed an investment company.

As a preliminary matter, at the time of our last response dated September 12, 2014, certain transactions were contemplated by Charter Communications, Inc. (“Charter”) and Comcast Corporation (as described in more detail in Amendment No. 3 to Broadband’s Registration Statement on Form S-1, as filed with the SEC on October 23, 2014) in connection with Comcast Corporation’s then-proposed acquisition of Time Warner Cable, Inc. (“TWC”), which would have resulted in the conversion of Broadband’s interest in Charter at the time into an equity interest in a new successor entity and the dilution of such interest to a then-undeterminable level. These transactions were ultimately abandoned in April 2015, several months following the completion of Broadband’s spin-off (the “Spin-Off”) from Liberty Media Corporation (“LMC”). On May 18, 2016, the previously

2

August 31, 2016

announced merger of TWC and Charter (the “TWC Transaction”) was completed, which resulted in Charter and TWC becoming wholly owned subsidiaries of CCH I, LLC (“New Charter,” which was a subsidiary of Charter at the time). Also on May 18, 2016, the previously announced acquisition of Bright House Networks, LLC (“Bright House”) from Advance/Newhouse Partnership (“A/N”) by New Charter (the “Bright House Transaction”) was completed. In connection with these transactions, Charter underwent a corporate reorganization, resulting in New Charter becoming the new publicly traded parent company. For purpose of the following discussion, we refer to Charter and New Charter as “Charter.” For more fulsome descriptions of these transactions insofar as they relate to Broadband’s interest in Charter, as well as certain agreements entered into by the various parties (including Broadband), we refer to you to Amendments No. 2 and 3 to Schedule 13D filed by Broadband with respect to Charter on June 1, 2015 and May 26, 2016, respectively (together, the “Schedule 13Ds”).

1. Asset Test. As disclosed in the Form 10-K, Broadband’s largest and most significant asset is its investment in shares of Charter Communications, Inc. (“Charter”) Class A common stock, par value $0.001 per share (“Charter Class A common stock”). As of June 30, 2016, Broadband reports total assets (exclusive of cash items) of approximately $9.3 billion, of which approximately $9.2 billion is comprised of the book value of Broadband’s Charter investment. The value of Broadband’s investment in Charter far exceeds 45% of Broadband’s total assets at such date, and, accordingly, Broadband deems itself to meet the asset test of Rule 3a-1 (subject to the additional discussion about Charter set forth below).

2. Income Test. For the four quarters ended June 30, 2016 (on a combined basis, the “Last Four Quarters”), Broadband reported net income of approximately $820.2 million and investment loss of approximately $71 million. Thus, Broadband’s investment income does not exceed 45% of Broadband’s net income for such period, and Broadband deems itself to meet the income test of Rule 3a-1 (subject to the additional discussion about Charter set forth below).

Accordingly, if (i) Charter is primarily controlled by Broadband; (ii) through Charter, Broadband engages in a business other than that of investing, reinvesting, owning, holding or trading in securities; (iii) Charter is not an investment company; and (iv) Broadband is not an investment company under Sections 3(a)(1)(A) or 3(a)(1)(B) of the Act, then Broadband should be entitled to rely on Rule 3a-1 as the basis for the conclusion that Broadband is not an investment company for purposes of the Act. For the reasons discussed below, Broadband believes each of the foregoing criteria has been met.

First, Broadband’s investment in Charter represents an approximate 17.1% ownership interest in the issued and outstanding shares of Charter Class A common stock (on a fully-diluted basis) and a beneficial ownership of approximately 25.01% (in each case, based on the number of shares of common stock of Charter reported by it as outstanding as of June 30, 2016). In connection with the TWC Transactions and the Bright House Transaction, Broadband entered into a proxy and right of first refusal agreement with Liberty Interactive Corporation (“LIC”) (the “LIC Proxy/ROFR Agreement”) and a

3

August 31, 2016

proxy and right of first refusal agreement with Advance/Newhouse Partnerships (“A/N”) (the “A/N Proxy/ROFR Agreement”) (please see Annex A attached hereto). Pursuant to the LIC Proxy/ROFR Agreement, LIC has granted an irrevocable proxy to Broadband to vote all shares of Charter Class A common stock beneficially owned by LIC, subject to certain limitations, and a right of first refusal over transfers of the Charter Class A common stock in certain circumstances. Pursuant to the A/N Proxy/ROFR Agreement, A/N has granted Broadband a 5-year irrevocable proxy to vote, subject to certain limitations, up to that number of shares of Charter Class A common stock and Charter Class B common stock, par value $0.001 per share,1 held by A/N (such shares, the “Proxy Shares”), that, combined with shares of Charter Class A common stock owned by Broadband and shares it has the right to vote pursuant to the LIC Proxy/ROFR Agreement, result in Broadband having voting power in Charter equal to 25.01% of the outstanding voting power of Charter; provided, that the number of Proxy Shares is capped at a number of shares having not more than 7.0% of the outstanding voting power of Charter. The number of Proxy Shares will vary from time to time based upon, among other things, the number of shares and voting power of Charter outstanding from time to time, the number of shares subject to the LIC Proxy/ROFR Agreement and the number of shares of Charter Class A common stock owned by Broadband. However, the maximum voting power of the Proxy Shares is subject to a cap of 7.0% of the outstanding voting power of Charter from time to time. A/N has also granted to Broadband a right of first refusal, in certain circumstances, for the five year term of the A/N Proxy/ROFR Agreement over the first and last common units of Charter Holdings (which are exchangeable into shares of Charter Class A common stock) (the “Holdco Units”) or shares of Charter Class A common stock issued upon exchange of Holdco Units proposed to be transferred by A/N that, in each case, represent 7.0% of the outstanding voting power of Charter calculated immediately following the completion of the Bright House Transaction.

Under Section 2(a)(9) of the Act, a person who owns beneficially, either directly or through one or more controlled companies, more than 25% of the voting securities of a company is presumed to control such company. Thus, by virtue of the size of its beneficial ownership stake in Charter, Broadband is presumed to control Charter.2 Moreover, Broadband “primarily” controls Charter because it is the largest single stockholder of Charter. For purposes of the Act, a company is controlled “primarily” by an issuer if the issuer has control over the company within the meaning of Section 2(a)(9) of the Act and “the degree of the issuer’s control is greater than that of any other person.” See Health Communications Servc’s, Inc., SEC No-Action Letter (pub. avail. April 26, 1985).

1 Charter Class B common stock represents the one share (which is the only issued and outstanding share of such class of common stock) issued to A/N in connection with the Bright House Transaction. One share of Charter Class B common stock has a number of votes reflecting the voting power of the common units of Charter Communications Holdings, LLC (“Charter Holdings”) and Charter Holdings convertible preferred units held by A/N as of the applicable record date on an if-converted, if-exchanged basis, and is generally intended to reflect A/N’s economic interests in Charter Holdings. Charter is a holding company whose principal asset is a controlling equity interest in Charter Holdings, an indirect owner of Charter Communications Operating, LLC, under which all of Charter’s operations reside.

2 The staff of the Division of Investment Management has recognized that voting control may be obtained through voting agreements with other stockholders of a corporation. See Farley, Inc., SEC No-Action Letter (pub. avail. April 15, 1988).

4

August 31, 2016

Second, through Charter, Broadband engages in a business other than that of investing, reinvesting, owning, holding or trading in securities. Broadband devotes substantial time and resources to overseeing Charter’s communications businesses, and actively participates in the governance of Charter. Pursuant to the Second Amended and Restated Stockholders Agreement, dated as of May 23, 2016, by and among Charter Communications, Inc., CCH I, LLC, Broadband and A/N, as amended (the “Stockholders Agreement”), Broadband has the right to designate three persons for election to the Charter board of directors, subject to certain exclusions and requirements. Such directors were appointed to the Charter board in connection with the closing of the Bright House Transaction (having previously served as members of the Charter board of directors prior to the TWC Transactions and the Bright House Transaction), and constitute approximately 23% of the total number of directors on the Charter board of directors. Pursuant to the Stockholders Agreement, Charter has agreed to cause one of Broadband’s designees to serve on each of the nominating and corporate governance, audit and compensation and benefits committees of the board, provided such persons meet the applicable independence and other qualifications for membership on those committees. Currently, directors designated by Broadband serve on each of the nominating and corporate governance and compensation and benefits committees.

Third, Charter is not an investment company, as defined under the Act. It is engaged, and holds itself out as being engaged, in the business of providing video programming, Internet services, voice services, and other communications services primarily over its cable plant to residential and commercial customers.

Finally, Broadband is not an investment company under Sections 3(a)(1)(A) or 3(a)(1)(B) of the Act. As described in the Form 10-K, Broadband is not and does not hold itself out as being engaged primarily in the business of investing, reinvesting, or trading in securities, and Broadband is not proposing to engage in such business. Moreover, Broadband is not engaged in the business of issuing face-amount certificates of the installment type, and no such certificates are outstanding. Instead, as described in the Form 10-K, Broadband is engaged in the business of managing its equity investments by actively participating in the governance and operations of the companies it controls, including Charter and TruePosition.

***

5

August 31, 2016

We inform you that:

|

· |

We are responsible for the adequacy and accuracy of the disclosure in the filing; |

|

· |

Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

|

· |

We may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions with respect to the foregoing or require further information, please contact the undersigned at (720) 875-4333.

|

|

Very truly yours, |

|

/s/Christopher W. Shean |

|

|

|

Christopher W. Shean |

cc:Richard N. Baer – Liberty Broadband Corporation

Renee L. Wilm – Baker Botts L.L.P.

6

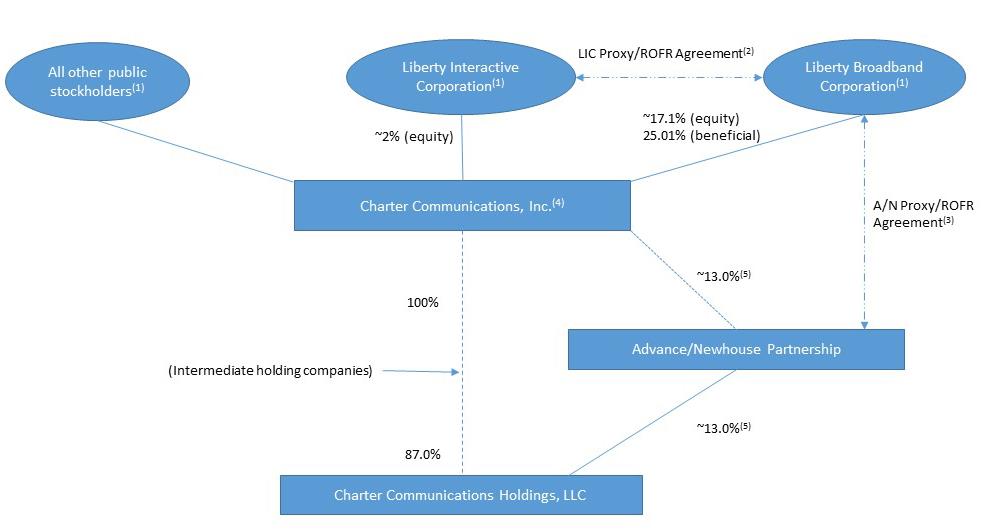

Annex A

|

(1) |

Represents ownership of shares of Class A common stock of Charter Communications, Inc. (“Charter”). Equity ownership presented on a fully-diluted basis. |

|

(2) |

Irrevocable proxy to Liberty Broadband Corporation (“Broadband”) from Liberty Interactive Corporation (“LIC”) to vote all shares of Charter Class A common stock beneficially owned by LIC (subject to certain limitations) and a right of first refusal over transfer of such shares in certain circumstances. |

|

(3) |

5 year irrevocable proxy to Broadband from Advance/Newhouse Partnerships (“A/N”) to vote (subject to certain limitations) up to that number of shares of Charter Class A common stock and Class B common stock held by A/N that, combined with shares of Charter Class A common stock owned by Broadband and shares it has the right to vote pursuant to the arrangement with LIC, results in Broadband having voting power in Charter equal to 25.01% of Charter’s outstanding voting power, capped at 7.0% of the outstanding voting power of Charter. Also provides for right of first refusal over certain shares/units (see page 4). |

|

(4) |

Outstanding common stock consists of shares of Class A common stock and one share of Class B common stock. |

|

(5) |

Interest in Charter Communications Holdings, LLC is through exchangeable common and preferred units representing approximately 13.0% common equity interest with voting rights in Charter (represented by one share of Charter Class B common stock) on an if-converted, if-exchanged basis. |